Gen TDS is currently the best TDS filing software available in the market with all the necessary features related to the filing of TDS returns. To add up, Gen TDS has a simple and user-friendly interface that is specially designed for taxpayers for the filing of TCS and TDS returns as per the regulations of the CPC and TRACES in India. The other distinctive features of this Indian government authorized TDS e-filing software include pre-determination of the TDS amount, calculation of interest and penalty along with late filing fee, preparation of TDS returns, and much more.

The effort that Gen TDS is making to become perfect in this field makes it stand among the leading the most popular and most recommended e-filing software. In The Fiscal Year 2012-13, it holds the topmost rank in the authorized Gen TDS Return Filing Software list of the Indian Government.

Procedure of Filing TDS Returns by Gen TDS Software

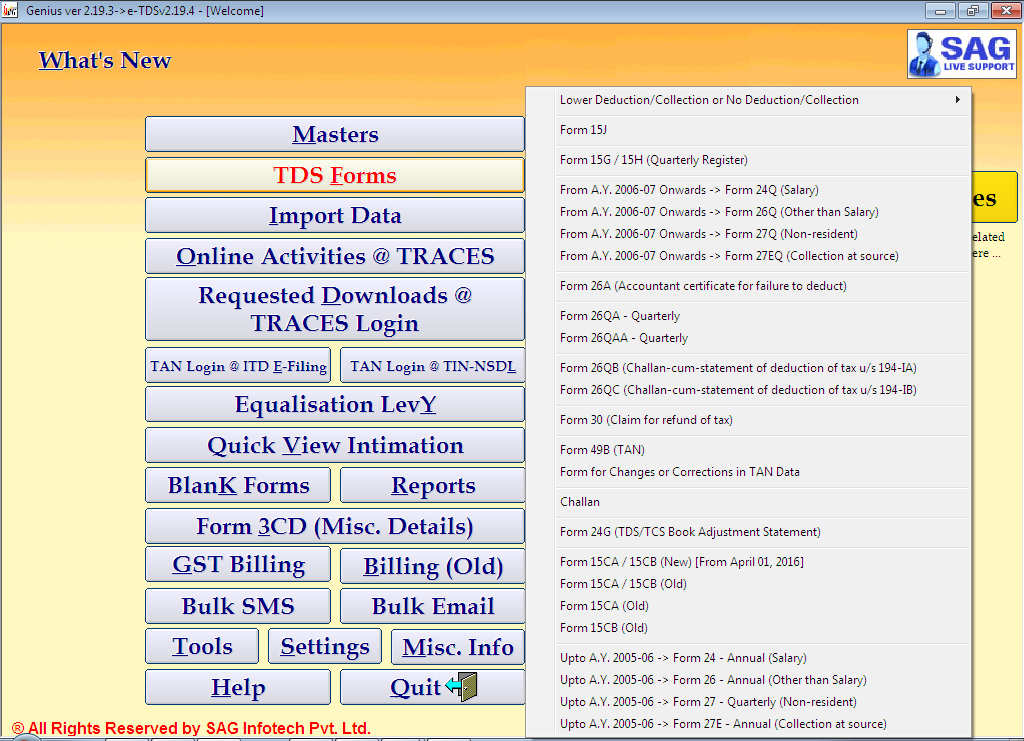

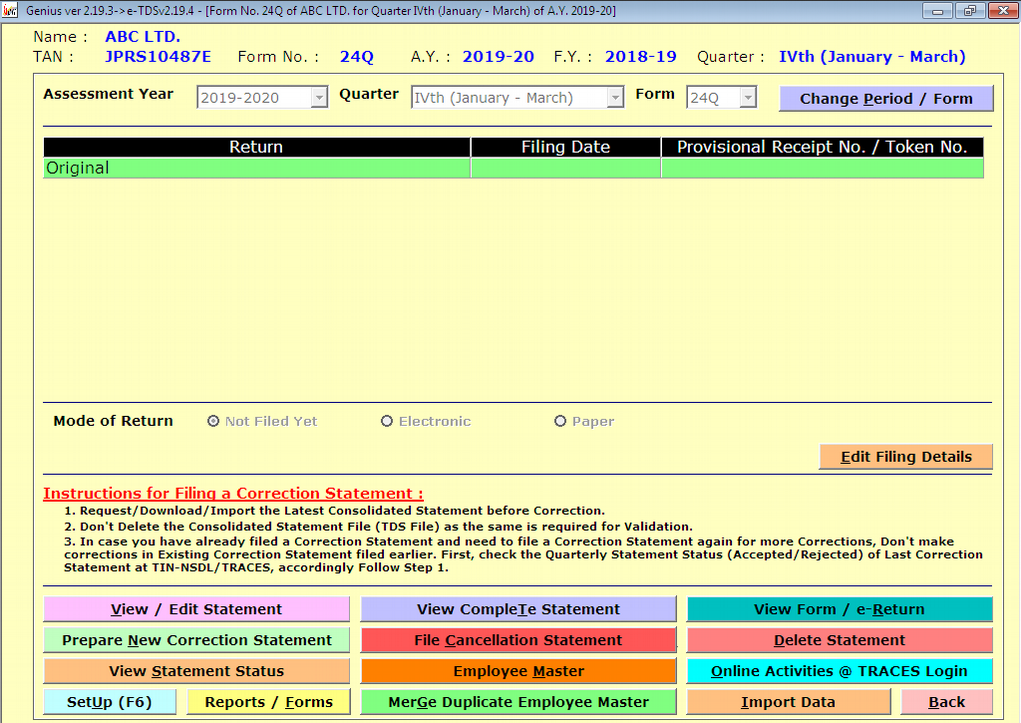

Step-1 The users must first click on the TDS Forms option from the above-given list. Afterward, the user must select the View/Edit statement as presented underneath:

Step-2: At this step, the users must provide their challan details by simply clicking on the ‘Add Challan’ option. For user ease, you can also import all the unconsumed challans from traces directly.

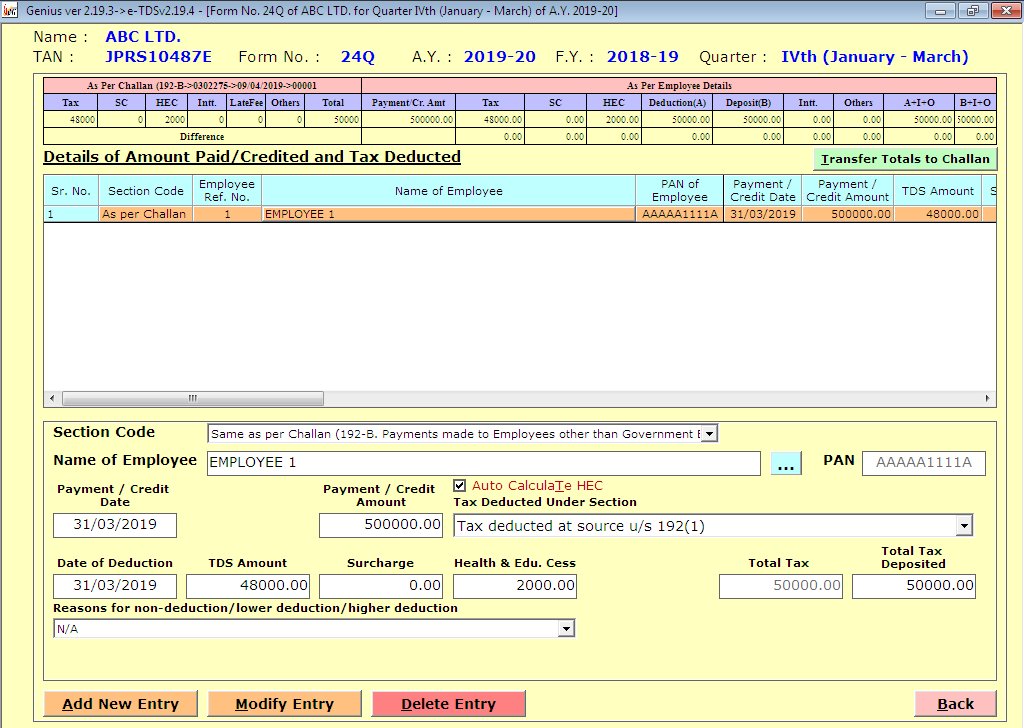

Step 3: At this step, the user must provide the employee/deductee information mapped to a particular challan by clicking on the “Employee/Deductee Details’’ option.

Step 4: Once the user enters all the details related to deductee, he/she must return to the main page by clicking on the View Form/E return” option.

Step 5: For verifying the challan status from the Traces and Olta, the user must click on the “Generate e-return” option.

Step 6: The user can also verify the PAN status of deductees from the Traces.

Step 7: The user will be presented with a summary report as given below:

Step 8: At this step, the user must click on the ‘Proceed’ option (as shown below) and by clicking on the same button, a fvu file will be generated, which can be uploaded by the user online. The file can also be submitted manually via IN FCs.

Gen TDS software is a solution provided by SAG Infotech Private Limited to accomplish all the TDS filing-related tasks. The company is offering a free Demo of Gen TDS Software for easy return filing. Get all the TDS return filing done on time with an error-less & seamless TDS filing tool.

Leave a comment