PAN and TAN Are Not Synonyms

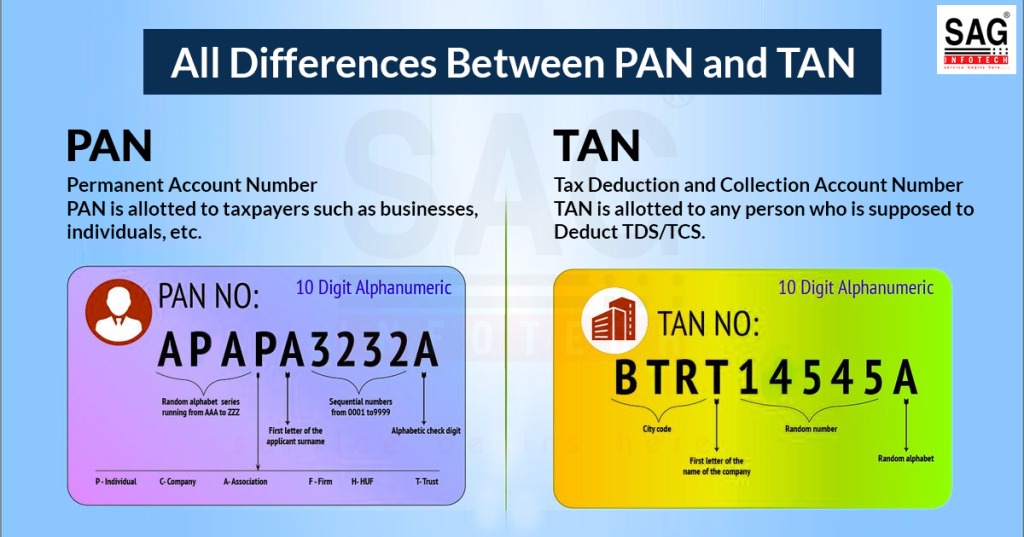

It is TAN not PAN. Most of us know that PAN stands for Permanent Account Number but few people know about TAN which stands for Tax Deduction and Collection Account Number

What is TAN?

Tax Deduction and Collection Account Number (TAN) can be defined as a ten-digit unique alpha-numeric number that is necessarily to be obtained/ acquired by all the persons who shoulders the responsibility for deducting or collecting the tax.

As per section 203A enshrined in the Income Tax Act 1961, it is compulsory to quote the Tax Deduction Account Number (TAN) by the deductor i.e. the person who is responsible for imposing and submitting tax in the government treasury. The Tax Deduction Account Number is allotted by the department of Income Tax for all the statements of the Tax Deducted at Source (TDS).

For facilitating TAN transactions, The Income Tax Department has introduced the search facility on the website http://www.incometaxindia.gov.in/ . Through this mechanism, the deductors can search by the name and old TAN to find out the new TAN.

Difference Between The PAN and TAN

PAN stands for the Permanent Account Number and the TAN stands for the Tax Deduction Account Number.

The TAN has to be acquired by the person who is responsible to deduct the tax (not the taxpayer) . The TAN number is quoted in case of all the documents that are associated with TDS and in case of all the correspondence between the deductor and the Income Tax Department.

PAN and TAN Are Not Interchangeable

Adding further PAN cannot be substituted for TAN. Both are required for different purposes and by different persons though there is an exception to this rule. In case of the TDS on the rent (as per the section 194-IB) and the TDS on the payment of the certain sum by the individuals of HUF (as per the section 194M), the deductor may use the PAN instead of TAN for the purpose of remitting TDS.

How to Apply for The TAN ?

There are 2 modes of applying for TAN: Online and Offline

- Online Mode

- Online Application for TAN could be made from the NSDL-TIN website.

- Offline Mode

- An application for TAN has to be filed in Form 49 B in the duplicate and has to be submitted to any of the TIN Facilitation Centres (TIN-FC). The address for the application is available at the website https://www.tin-nsdl.com/

However, in case of a company that has not been registered as per the Companies Act 2013, the application for the allotment of the Tax Deduction Account Number shall be made in Form Number SPICe (INC-32) that has been specified under the sub-section (1) of the section 7 of the aforesaid act for the incorporation of the Company.

Leave a comment